News

News

In Boost for Hotels, Bill to Remove Dominican Republic Tax Incentives Withdrawn

The Caribbean Hotel and Tourism Association partnered with the Dominican Republic’s hotel association, ASONAHORES, to oppose a proposed tax reform bill that would have eliminated key tourism incentives. The measure, which had been under discussion as part of a broader […]

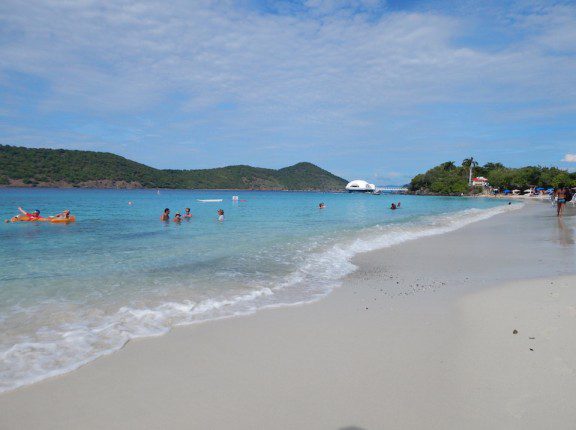

The US Virgin Islands Is Raising Its Hotel Tax

By the Caribbean Journal staff The US Virgin Islands’ hotel tax is going up. The United States Caribbean territory has announced that its hotel room tax will increase to 12.5 percent from 10 percent, a 25 percent increase. US Virgin […]

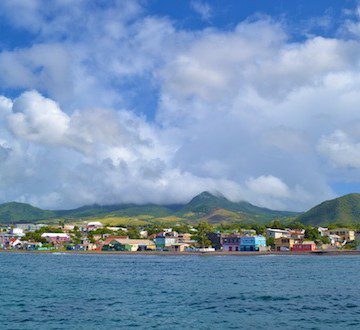

St Kitts and Nevis, United States Sign FATCA Agreement

Another country to implement FATCA By the Caribbean Journal staff St Kitts and Nevis has signed an agreement with the United States to implement the US Foreign Account Tax Compliance Act. The act, which was enacted by Congress in 2010, requires foreign […]

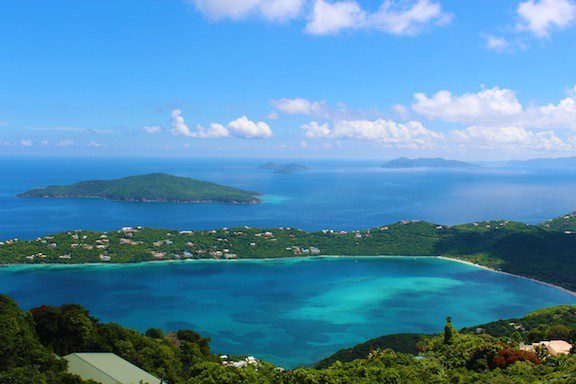

How to Move to St Thomas, US Virgin Islands

It’s a dream for many — picking up and moving to the Caribbean. And every year, many people do just that. Of course, moving to any island has its own benefits and challenges — and we’re here to help. Our new […]