News

News

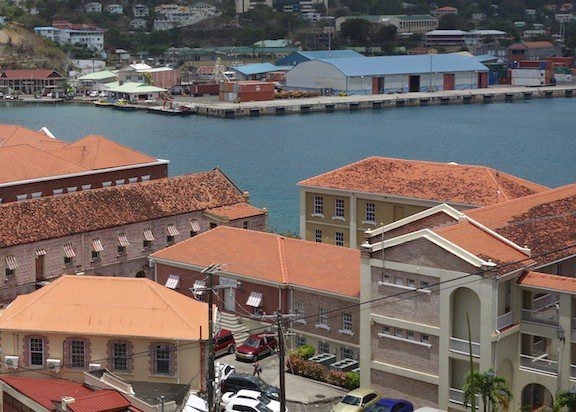

St Kitts and Nevis, United States Sign FATCA Agreement

Another country to implement FATCA By the Caribbean Journal staff St Kitts and Nevis has signed an agreement with the United States to implement the US Foreign Account Tax Compliance Act. The act, which was enacted by Congress in 2010, requires foreign […]

Op-Ed: Money Laundering in Jamaica

By Ramesh Sujanani Op-Ed Contributor Jamaica recently welcomed a new head of the FID, an organization which has much to do with cash, currencies and their movement in Jamaica, along with maintaining a liaison with overseas administrators of similar programmes. […]

Op-Ed: FATCA’s Impact on Jamaica

By David Rowe Op-Ed Contributor Jamaican green card holders and US citizens resident in Jamaica should be aware of the FATCA statute. The Foreign Account Tax Compliance Act has been passed and will affect these two categories of individuals when […]