By Kent Gammon

Op-Ed Contributor

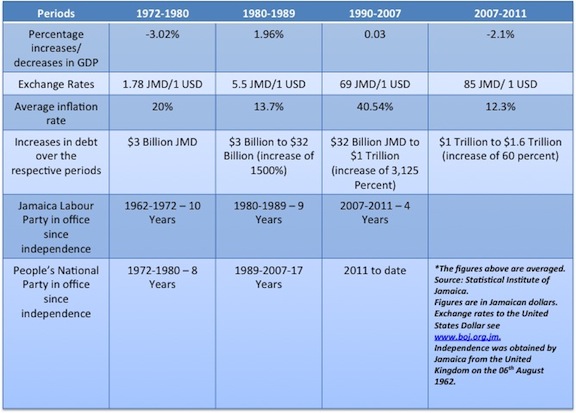

The state of the Jamaican economy over successive administrations tells the story of Jamaica’s evolving debt trap.

The distinction that should be appreciated amongst successive administrations is how well each managed (or perhaps more appropriately mismanaged) the country’s affairs.

How did Jamaica become so debt burdened?

The current Prime Minister, Portia Simpson Miller, has said recently that, next to debt servicing, the cost of energy is the biggest constraint on Jamaica’s budget. It was her administration that caused the two biggest problems on the country’s budget.

In support of this assertion it was the PNP administration of which the Prime Minister has been a cabinet minister at all material times that racked up an unprecedented debt stock that Jamaica will never be able to pay back on its current economic trajectory.

It was the politically expedient policy of the 1990s to flood second hand cars into Jamaica (described by Jamaicans as “deportees”), rather than an economically sound policy of improving public transportation, that has led to the massive demand for several years for oil and petroleum.

The country’s debt burden stymies the country’s productive output by taking away from the country’s capital stock while increasing the debt stock.

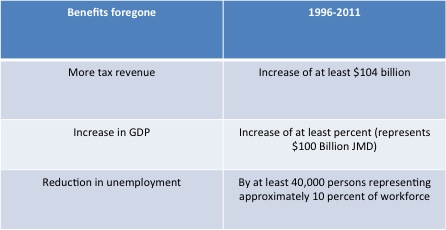

The Financial Services Adjustment Company (FINSAC) was formed in 1996 ostensibly to take over financial institutions allegedly reckless with other people’s money. To compound the debt trap debacle over the period 1993 (a year that had a sharp increase in inflation) to 2011 average interest rates ranged from over 78 percent to 18 percent and the total debt of FINSAC at April 2004 was JMD $104.77[1] billion.

The Jamaican business community by and large was unable to compete with their Trinidadian business counterparts who enjoyed average interest rates of 11 percent over the entire period 1993 to 2011 while the Jamaicans had to grapple with average interest rates of 19 percent.

And as if that wasn’t bad enough a bankrupt electricity company called Mirant was granted a secret license in March 2001 to generate and distribute electricity to the Jamaican public. The price of electricity has remained at uncompetitive levels averaging USD 0.44 cents per kilowatt as compared to USD 0.12 cents in Trinidad and Tobago.

It should be remembered that over the period 1992 to 1997 average interest rates ranged from as high as 80 percent to 30 percent.

The Opportunity Cost of FINSAC

Had the money from FINSAC remained in the local domestic banking sector some 40,000 persons directly affected by FINSAC would have resulted (it is theorized) in the following benefits to Jamaica:

Adjusting the total debt stock for inflation over the successive governments adds no greater value to the topic of this article other than worsening the prospect of paying off the debt stock. But to eliminate any accusations of comparing apples with oranges as one talk show host has opined[1] when comparing the total debt stock figures we will adjust for inflation.

The adjustment for inflation on the debt stock means that it will require approximately on average seventy times more Jamaican dollars to pay off the debt now using 1989 as a base value year.

The conclusion reached in the documentary “Life and Debt[2]” to blame the International Monetary Fund for Jamaica’s gargantuan debt burden was disingenuous and was an attempt to hold a third party responsible for Jamaica’s debt burden. The debt crisis straddling the Jamaican economy is preponderantly home grown. The Jamaican economy declined by 22 percent over the period 1972 to 1980 and never recovered from the socialist excursion of that period.

In fact the debt trap was exacerbated due to the high interest rate polices of the Patterson administration continued by the Simpson-Miller administration. The current finance minister’s lamentation that that the “economic cupboard” was empty when his administration took over in December 2011 is to belie the fact that the “economic cupboard” was emptied by his administration,

particularly over the period of the 1990s whose economic policies and philosophy are greater ‘pie sharing’ rather than “pie enlarging.”

Some forward thinking now

The only way out of the debt trap is to downsize it with greater productivity and innovative debt management.

Three immediate solutions proposed to solving the debt trap are:

(1) A further lowering of interest rates so that businesspeople can get back into growing the economy on a wider scale as in the 1960s and 1980s. More productivity equals more revenue.

(2) A more efficient tax collection system so that all tax payers pay their fair share. As it now stands only 30% of the entire corporate community pays their taxes. This is untenable. The Private Sector Organization of Jamaica’s tax reform proposal makes sense and should be adopted now.

(3) Tackling the social ills in the country. To improve the housing conditions and get rid of ‘squatter settlements’ rife throughout Jamaica must rank as another top priority. The estimated 900,000 squatters need to have their living conditions legalized and this will concomitantly improve their self-esteem. An improved self-esteem goes a long way to lifting the productivity quotient.

The challenge is put squarely to the current Simpson-Miller administration to focus on growing the economy and not growing the debt.

[1] Ronald Mason on the talk show “On the Agenda”.

[2] The 2001 film’s Assistant Producer was Michael Manley’s third daughter, Sarah Manley.

[1] Sources: Ministry of Finance and Statistical Institute of Jamaica (STATIN)

Kent Gammon is a former candidate for the Jamaica Labour Party and an Attorney-at-law.

Note: the opinions expressed in Caribbean Journal Op-Eds are those of the author and do not necessarily reflect the views of the Caribbean Journal.