Why Residential Resorts Could Boom in the Caribbean

By Joe Pike and Alexander Britell

When travel fully resumes either during or following the coronavirus (COVID-19) pandemic, experts are predicting a residential resort investment spike in Caribbean destinations that can offer both low density properties and seclusion.

Caribbean Journal Invest (CJI) spoke to some of the top tourism and real estate firm representatives in Turks and Caicos, Barbados, the Cayman Islands and Antigua to find out more about the present and future residential resort market in those destinations.

“Generally speaking, residential-style resorts have less density and larger common area spaces,” said Stan Hartling, owner and CEO of The Hartling Group in Turks and Caicos. “This will be an important consideration for purchasers and guests alike.”

Hartling said owning a residential resort is a good “quality-of-life investment that still offers security and returns” mainly due to “current fluctuations in the stock market and low interest rates.”

“A properly structured residential resort formula can be a great way to diversify risk throughout the various stakeholders in the project,” he said. “Unlike a conventional hotel model that can only be valued on its capitalized income, the residential resort model has an advantage in that the value of the room product is not being solely linked to the financial performance.

“Residential resort buyers can take comfort that they have a separate underlying real estate value regardless of a specific income stream,” said Hartling. “These buyers also have an incremental implied value in personal usage, which does not exist in a pure hotel-only investment platform.”

And the proof of the market’s current and future potential can be found right in The Hartling Group’s own backyard.

“Today, likely 75-plus percent of the resort room product in Turks and Caicos has been developed under some form of residential resort model,” said Hartling. “This is largely due to the benefits mentioned above that make the model economically viable in destinations that have higher operating and development costs.”

Hartling also credited Turks and Caicos’ reputation for high-end service and ample room space at hotels for drawing the interest of investors.

“The model is perfect for ultra-luxury destinations where the expectation of the room quality and size is much higher,” said Hartling. “The residential resort model allows a much higher investment per key because of its underlying real estate-based valuation.”

Aside from Turks and Caicos, investor interest in residential resorts are popular in the Caribbean in general, said Craig Eddins, managing director for IMI World Properties in Barbados.

“In my opinion, time is the most valuable commodity, and time well spent is priceless,” said Eddins. “The ability to own a piece of a luxury resort with well-appointed amenities and thoughtful experiences located in the geographical area that suits your desires is the reason behind this growing development trend and a good way to spend some of that valuable time.

“The Caribbean is the location that checks that box for many people, my family and myself included.”

Eddins also cited investors’ desire to own homes that come with top-notch hospitality as another contributor to the residential resort market’s potential growth.

“The buyer today is also looking to maximize their investment dollar,” he said. “We offer a product that, when not in use by the owner, can be rented by other resort guests, providing an income stream to offset acquisition and operation costs. There is also significantly better re-sale opportunities for owners as the integrity and consistency of the resort brand will instill confidence in future buyers.”

So, how does an investors’ interest in an island coincide with a travelers’ desire to visit that destination?

“Today’s travelers are experience driven,” said Eddins. “The old adage of ‘work hard, play hard’ is absolutely true today. Our owners and resort guests take their vacationing as serious as their work. They want to be active outdoors, whether boating, diving, surfing, mountain biking, horseback riding, or even watching or playing polo.”

Sue Nickason, vice president of real estate marketing and sales for Dart Real Estate in the Cayman Islands, told CJI the Cayman Islands is popular among both travelers and investors because it is “a destination already popular with those in the know.”

“Cayman offers discerning travelers more than luxury and privacy in the seclusion of their own home, it allows people to keep a low profile when out and about in public,” she said. “Laid back and unostentatious, people in Cayman welcome all visitors alike.”

Nickason said anywhere on Seven Mile Beach, the East End, Rum Point and Kaibo, are great spots for development of residential resorts in the Cayman Islands.

Nickason said these are some of the top advantages the Cayman Islands has when attracting those looking to buy property: tax neutrality (there is no recurring property taxes); there are no restrictions on foreign ownership of property and there are no alien landholding licenses required.

Nikheel Advani, COO and principal of Grace Bay Resorts in Turks and Caicos, also said safety and proximity will continue to make Turks and Caicos a safe bet for those looking to pour money into the residential resort market or those looking to protect an investment already made.

So, what specific areas of the destination are particularly popular amongst residential resort development?

“All over Providenciales, however, the North Shore and South Shore have been pretty popular,” said Advani. “We are seeing a lot more independent private villas in these areas as well.”

And who is the typical residential resort investor in Turks and Caicos?

“[They] typically come from the tri-state area and Canada,” said Advani. [They are between the ages of] 45 to 55 [and are] in the top one percent [of the overall U.S./Canadian income bracket]. [They are] looking for safety and things to do. The average time they personally spend here is about six weeks per year.”

Dean Fenton, U.S. director for the Antigua and Barbuda Tourism Authority, said the profile of the hotel investor in Antigua is slightly different.

“Historically, if we look at Antigua Village which has been a condo resort for nearly 40 years,” he said. “The first owners were predominantly British, and come and spend the winter months living in their condo and put it into a rental pool when they are not using it. These days the new owners are younger, more from the U.S. and are looking more to rent the units for an income than for personal use.”

Fenton told CJI he expects sought out areas for residential resort development to include Jolly Habour, Fort James, Falmouth Harbour and English Harbour.

Much of that development, including many of the high-profile projects in Antigua, is being driven by citizenship by investment programs, which confer citizenship for buyers who meet a certain investment threshold.

Those programs make residential resorts even more appealing.

“Many of the islands have very similar CIP (Citizenship by Investment Program) type programs aimed at driving real estate sales, Antigua is no different,” said Fenton. “Antigua’s advantage is an established tourist destination with good airlift from our key markets in the U.S., Canada and Europe.”

He said he expects residential resort business to soar when travel fully returns to Antigua because the condo-resort concept offers exactly what people will be looking for during and after the COVID-19 pandemic.

And now is the time to invest since Fenton said the residential resort market is still limited and is only a small percentage of the total room stock in Antigua, so there is plenty of room for growth.

“Antigua is one of the last authentic Caribbean islands and, with restrictions in place, development will be controlled to preserve this trait,” he said. “Antigua will never have the large high-rise resorts seen elsewhere. Real estate prices are high in Antigua and are not subject to market fluctuations as seen in the U.K and U.S. Also, being a small island the amount of available land for development is extremely limited so land prices can only go up in the future.”

Residential Resort Success

Some of Dart’s best residential resorts in the Cayman Islands include Kimpton Seafire Resort + Spa’s The Residences at Seafire, and The Ritz-Carlton, Grand Cayman, which has independently owned condos. Nickason said owners of some of the condos put their properties in short-term rental programs.

Among IMI’s best residential resorts is Saint Peter’s Bay Luxury Resort and Residences, which is designed in the traditional Caribbean style of architecture and offers 57 beachfront residences in a tropical garden setting in Barbados.

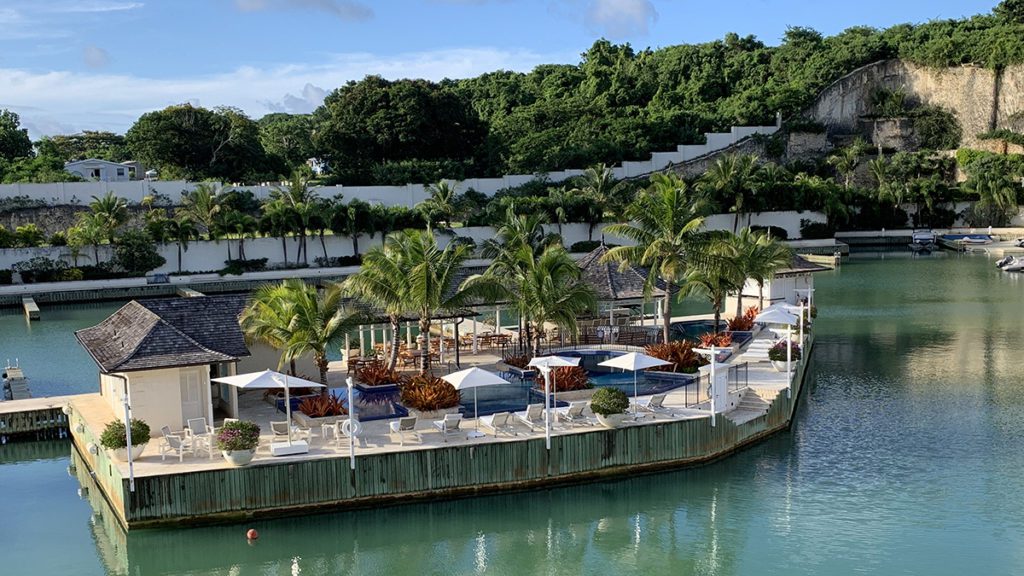

Another IMI success story is Port Ferdinand Yacht & Beach Club Residences, which combines a marina with luxury villas, and the services and amenities one could expect from a five-star hotel.

Currently, Grace Bay Resorts’ most-buzzed-about residential resort is Rock House, a cliffside property that is due to open next year. The Hartling Group’s hottest hotel with a residential component is The Shore Club Turks and Caicos, which is reopening in July.

And Antigua?

“Currently, in this sector,” said Fenton, “we have Tamarind Hills, Nonsuch Bay [Resort], South Point [Antigua], Hodges Bay [Resort & Spa] and the oldest example in Antigua Village.”

“The condo-resort sector will fare well after the pandemic,” Fenton said. “Some guests, especially those in the high-risk category of the population, will avoid the large resorts where guests are more crowded together. They will seek their own space, which they can find within a condo concept. The high risk, more elderly sector, also tend to have more disposable income, which fits well within the condo concept.”