By Paul Hay

CJ Contributor

In an article in Jamaica’s Sunday Gleaner dated 21 April 2013 titled: “More Lessons from the Past – Missed Energy Opportunities”, William Saunders, Energy Consultant, outlined Jamaica’s failure to act upon initiates to diversify its energy mix from 1978, when Jamaica formulated its first energy plan.

In a much earlier article in Jamaica’s Sunday Gleaner dated 30 March 2008 titled: “Jamaica’s Energy Challenge – part III”, Zia Mian, a retired senior World Bank official and international energy consultant, stated that: “Jamaica’s economy is relatively energy intensive.”

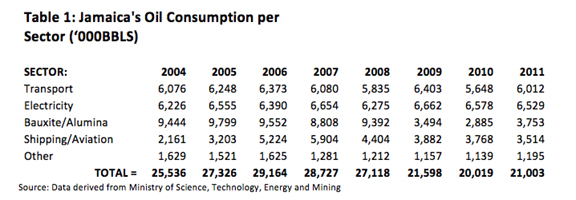

Jamaica has one of the highest rates of energy consumption in Latin America and the Caribbean region. This is mainly due to heavy usage by the bauxite/alumina sector. The oil consumption per sector from 2004-2011 is shown in table 1.

in an article titled: “Energy Cost and our Economic Future – Future of Alumina Sector Hinges on Energy Cost”, in the Mona School of Business Nov/Dec 2011 issue, Carlton Davis, former Cabinet Secretary and chairman of the Jamaica Bauxite Institute, stated, that:

“Given the importance of the cost of energy in the production of alumina and the consensus that oil will be more expensive over the long-term than natural gas or coal it is incumbent that oil is replaced by one of these two fuels… (and) Government has a lead role in affecting this transformation.”

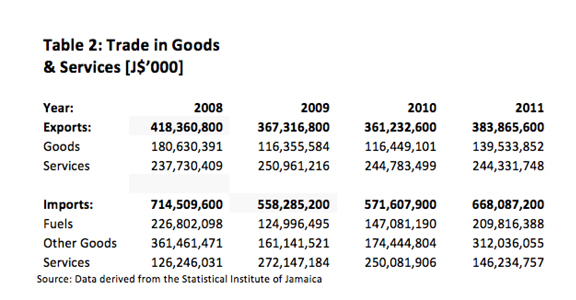

The cost to import fuel into Jamaica from 2008-2011 is shown in table 2. Fuel is by far the largest expenditure on imported goods. With the exception of 2009 and 2010, the cost of importing fuels was greater than half of the returns from exports.

Jamaica has a serious trade deficit, and oil is a major contributor. Devaluation normally boosts exports, but not in Jamaica. An assessment of Jamaica’s exchange rate policy from 1962 onward appears in an academic paper by Dr Michael Witter’s titled: “Exchange Rate Policy in Jamaica: A Critical Assessment.”

Jamaica has a serious trade deficit, and oil is a major contributor.”

He concluded that devaluation had the effect of inflating the value of imports significantly over that of exports. Cheap oil imports which prevailed in the 1950s through to the OPEC action in 1973 factored in Jamaica’s economic growth.

But, oil prices are projected to reach US$150 – US$200 in the near future.

Prior to the global recession in 2008, consumption in the shipping/aviation sector has also risen. As the global economy recovers and Jamaica completes its logistical hub, in preparation for the widening of the Panama Canal, this sector could easily overtake the electricity sector in its use of energy.

Promising signs on the horizon need to produce tangible results. Construction of the 381 MW, LNG-fired power plant is one of them. The Private Sector Organization of Jamaica (PSOJ) needs to consider Jamaica’s history of missed opportunity and reconsider their involvement in this project.

Paul Hay, a Caribbean Journal contributor, is the founder and manager of Paul Hay Capital Projects.