Above: the Bahamas (CJ Photo)

By the Caribbean Journal staff

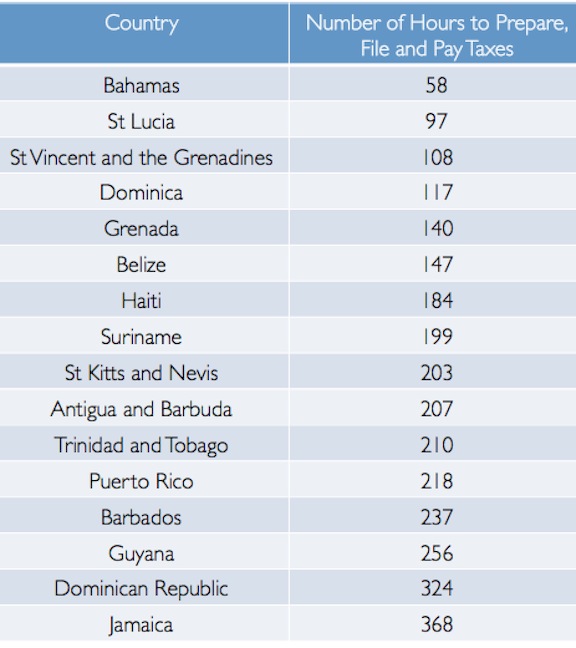

We continue our series on business in the Caribbean with a look at another important data set from the World Bank: how long it takes for a business to pay taxes in the Caribbean.

Following our look at the amount of tax businesses pay in the region, we looked at how Caribbean countries stacked up against one another when it comes to the amount of time it takes to pay taxes.

The World Bank’s Doing Business project data set defined the time to prepare, file and pay taxes “in hours per year, it takes to prepare, file, and pay (or withhold) three major types of taxes: the corporate income tax, the value added or sales tax, and labour taxes, including payroll taxes and social security contributions.

So who came out on top? The Bahamas, where it took just 58 hours to prepare, file and pay taxes, followed by St Lucia, where it took 97 hours.

The Bahamas was actually fourth-best in the world in that regard.

Last on the list? Jamaica, where it took 368 hours for a business to prepare, file and pay taxes.

As a point of reference, it took 175 hours to prepare, file and pay taxes in the United States, and just 12 hours in the United Arab Emirates.

Note: as has been the case with the World Bank business data set, Caribbean overseas territories and non-sovereign countries were not included, with the exception of Puerto Rico.

The data covered 2013.

See below for the full ranking: