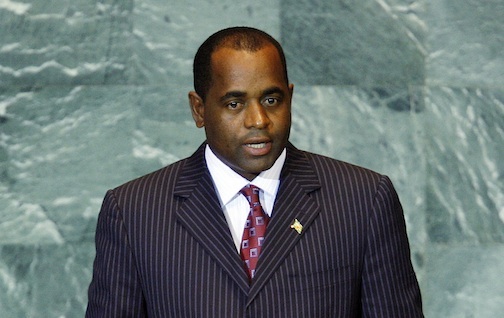

Above: Dominica Prime Minister Roosevelt Skerrit (UN Photo/Marco Castro)

By the Caribbean Journal staff

Dominica has no plans to remove or create an exemption for the country’s value-added tax, according to Dominica Prime Minister Roosevelt Skerrit.

To do so, he said, would cause damage to the country’s economy.

“I’d like to say to certain groups and individuals who continue to make calls to this government for the removal of VAT or exemptions of VAT that they should not pursue the call if they are really interested in the well-begin of this country,” he said this week. “If we want our government to be reckless and irresponsible, the consequences of these things can be detrimental to the well-being of the country.”

Skerrit, who is also Dominica’s Minister for Finance, said he urged the government not to entertain “any such requests for further exemptions or even consider the removal of VAT at all.”

“From where I stand or sit as Minister for Finance, if we were to change any of these things, it would mean going back to a very stringent IMF programme, making a series of cuts and we would be hurting more than we claim we are, under the VAT regime,” he said.

Dominica’s VAT stands at 15 percent.

Skerrit said his government had moved to lower several other taxes, however, including consumption tax and hotel occupancy tax, along with a reduction in income tax.

“Over the years, we have reduced the income tax so that more of you working class people in Dominica would go home with, if not all of your salary, most of it,” he said. “When I look at most of us who pay taxes in Dominica, not many of us pay much tax.”

Another Caribbean country, St Lucia, plans to begin implementation of its own VAT this month.