By James Andrews

CJ Contributor

The Grand Cayman office market is largely dependent upon the financial services sector, which loosely includes legal services, accounting services, domiciled funds, trusts, and insurance captives. This sector appears relatively stable at present; however, there is increased external scrutiny and pressure for transparency for tax reasons. These issues have not resulted in a decline in the Class A office market, but are worthy of monitoring in the coming years.

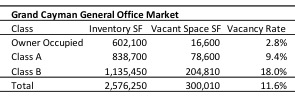

Based on our research, the total market for existing space, excluding Class C office buildings, totals about 2.58 million square feet, with about 1.14 million square feet attributed to Class B space and 838,700 square feet of Class A space. The definition of what is Class A has changed somewhat in the last five years, with the bar having been raised by the most recently constructed projects.

Inventory growth is continuing in the Class A sector, with the large scale Camana Bay development starting construction of an additional 80,000-square-foot office building as a part of a wider expansion of its Town Centre. The sixth phase of the Cricket Square office park is anticipated to break ground in the near future and it will add another 106,000 square feet of Class A space. Upon completion of these projects in 2017/2018, Class A space will break through the 1 million square feet barrier (excluding owner occupied projects) and approach Class B inventory for overall size.

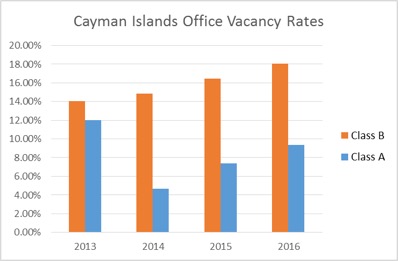

The overall vacancy rate is currently 11.6 percent, but the rate jumps to 14.4 percent when excluding all owner-occupied space. Compared with data from the last two years, vacancy rates have increased, largely due to new Class A inventory coming on stream. The underlying trend is that although available inventory has increased, the amount of occupied Class A space has also increased compared to prior years.

It is apparent that the higher vacancy trend in Class B relative to Class A space continues, indicating stronger demand in this sector for higher quality accommodations. The current vacancy for Class A space is 9.4 percent, up from 7.4 percent one year ago. More notably, the vacancy rate for Class B space is at 11.7 percent, up from 10.38 percent in early 2015.

The highest vacancies are in the lower-class buildings, as the financial services firms are more desirous of Class A space that has higher-quality finishes, back-up generators, and amenities. Another factor affecting demand for Class A space is several local law firms have merged with larger international practices that require larger and nicer accommodations.

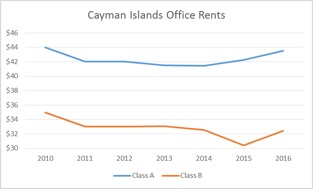

The reported rents achieved for Class A space range from US $39.00 to US $50.00 per square foot with the highest rates being in larger, modern developments such as Cricket Square and Camana Bay. The achieved rates for the various Class A buildings currently average about US $44.00, indicating some growth over the past two years.

Achieved rates in Class B buildings range from US $24.00 to US $43.00 per square foot, averaging about US $32.00 per square foot. This represents a slight improvement over one year ago, but is still slightly less than average rents in this class in years prior. The average rates which we track include existing tenants; new lease rates are trending slightly higher than the average, particularly for Class A space.

Common area maintenance (CAM) charges for Class A space range from US $10.50 to US $16.50, averaging at US $14.00. Charges for Class B buildings range from US $0 (included in rent) to US $14.00, with an average of about US $11.00 for those buildings which itemize a separate CAM charge.

The market for Class A space continues to moderately improve despite additional inventory coming online. The addition of new office space in Cayman coupled with local economic factors is resulting in higher than typical vacancies and downward pressure on rents for Class B and C buildings. It is notable that several spaces within the Class B sector are now being offered inclusive of CAM. Note that our survey excludes Class C space, which is also experiencing high vacancy rates and downward pressure on rents due to the availability of relatively affordable options for higher quality space.

James Andrews is Senior Managing Director of Integra Realty Resources Caribbean, which provides real estate and business valuation and counseling services throughout the Caribbean region, with offices in the Cayman Islands, U.S. Virgin Islands, and the Bahamas.

To download Integra Realty Resources’ (IRR) full Grand Cayman office market report, visit: www.irr.com/caribbean.